New York Climate Corporate Accountability Act

This article delves into Senate Bill S897A, requiring businesses with over $1 billion in revenue to report emissions to an emissions registry. Discover the nuances of the bill, its deadlines, and how it compares to California's SB-253, all aimed at promoting sustainability and corporate accountability.

In January of 2023, New York proposed Senate Bill S897A, which would require businesses with over $1 billion in revenue the previous calendar year to report scopes 1, 2, and 3 emissions to an emissions registry. Additionally, the bill would require emissions reports to be independently verified for accuracy and completeness. The New York Climate Corporate Accountability Act is similar to California’s Climate Corporate Data Accountability Act. This article provides an overview of the New York proposed Senate Bill S897A and highlights its distinctions from California’s SB-253.

Who and What

The proposed bill will require all entities with over $1 billion in revenues earned from subsidiaries that do business in New York to report their emissions in the following year. The $1 billion threshold only includes revenue from subsidiaries that operate in New York and not revenues from subsidiaries that do not operate in the state.

Companies meeting the threshold are obligated to report emissions information to an emissions registry. The bill defines an emissions registry as “an entity within the department or a nonprofit emissions registry organization contracted by the department that either currently operates a voluntary greenhouse gas emissions registry for organizations operating in the United States; or has experience with voluntary greenhouse gas emissions disclosure by entities operating in New York.”[1] The proposed bill includes definitions for scope one, scope two, and scope three emissions. Understanding these definitions is vital to ensuring compliance with the mandatory requirements outlined in emissions reports submitted to the emissions registry.

Scope 1 emissions are “all direct greenhouse gas emissions that stem from sources that a reporting entity owns or directly controls, regardless of location.” This indicates that if a company operates in New York and meets the $1 billion threshold, they are obligated to include subsidiary information in the report, whether or not those subsidiaries operate in New York.

Scope 2 emissions are “indirect greenhouse gas emissions from electricity purchased and used by a reporting entity, regardless of location.”

Scope 3 emissions are “indirect greenhouse gas emissions, other than scope two emissions, from activities of a reporting entity that stem from sources that the reporting entity does not own or directly control and may include, but are not limited to, emissions associated with the reporting entity’s supply chain, business travel, employee commutes, procurement, waste, and water usage, regardless of location.” This definition of scope three emissions does not vary significantly from that of other regulators such as the ISSB.[2] To learn more about scope three emissions, see our article here.

The bill references mandatory resources that must be consulted when reporting scope 3 emissions data. Namely, companies must adhere to the Greenhouse Gas Protocol Corporate Accounting and Reporting Standards and the Greenhouse Gas Protocol Corporate Value Chain Accounting and Reporting Standards. These standards provide a step-by-step guide for quantifying and reporting GHG information.[3] The bill requires entities to consult the “guidance for scope three emissions calculations that detail acceptable use of both primary and secondary data sources, including the use of industry average data, proxy data, and other generic data.”[4] The greenhouse gas protocol website offers various Excel workbooks to assist companies in calculating their GHG emissions. The guidance provided for reporting entities is comprehensive. It includes examples and steps to aid entities in their calculations of scope three emissions to promote comparability.

When

The following reporting deadlines are mandatory under the bill, except under certain circumstances that will be outlined later in this article.

The intention of these deadlines is to ensure that the disclosure of scope three emissions data aligns as closely as possible with the disclosure of scope 1 and scope 2 emissions while recognizing that scope 3 emissions reporting requires more extensive data from a variety of sources. These dates are subject to change as trends in scope 3 emissions reporting change overtime. Before submitting emissions disclosures to the emissions registry, entities’ disclosures need to be subject to independent verification by a third-party auditor approved by the department. The department will establish auditor qualifications and a process for auditor approval. All emissions information will be made publicly available through the emissions registry.

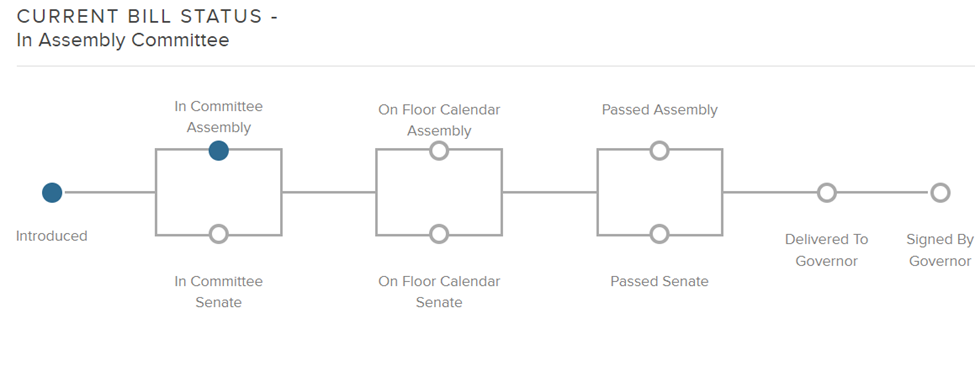

The law will be in effect two years from the day that the bill is signed into law. As of the publishing of this article the bill was sitting with the finance committee in the Senate. The graphic below shows a depiction of the status of the bill.[5]

Consequences

Reporting entities that choose not to comply with the requirements in the bill may be penalized up to one hundred thousand dollars per day. This will be enforced by the attorney general.

Similarity to California’s SB-253

The New York Climate Corporate Accountability Act is Similar to California’s SB-253 law, which requires companies (both public and private) that “do business in California” with over $1 billion in revenue to report Scope 1, Scope 2 and Scope 3 emissions. The following summarizes the similarities and differences between the two bills:[6]

- Both require annual reporting

- Both leverage the GHG protocol

- Both require public disclosure on a digital platform

- Both enforce non-compliance and impose penalty fees, although California’s are much lower at $500,000/year and New York’s are set at $100,000/ day

- Both encourage companies to disclose scope 3 emissions as close as practicably possible to the disclosure of scope 1 and 2 emissions

- Both will continue to evaluate scope 3 disclosure deadlines based on reporting trends

- Both allow for a transition period that doesn’t require scope 3 emissions reporting until two years after the bills are passed

- The phase in period for assurance is longer for California, starting with limited assurance for Scope 1 and Scope 2 emissions and then expanding to reasonable assurance and limited assurance on scope 3 emissions in 2030

- CARB is setting the reporting deadlines for California, while New York has already established reporting deadlines

In general, because the California Bill has already passed it incorporates a greater level of detailed information.

Conclusion

The New York Corporate Climate Accountability Act aims to incentivize corporations to adopt more sustainable practices by mandating that companies with revenue from subsidiaries operating in New York that exceed $1 billion disclose their scope 1, scope 2, and scope 3 emissions. The legislation intends to "amend the environmental conservation law, addressing climate corporate accountability." While the bill is currently in its early stages of approval, it is anticipated to have a comparable impact to California's SB-253.

[1] https://www.nysenate.gov/legislation/bills/2023/S897/amendment/A#:~:text=2023-S897A (ACTIVE) -,two and scope three emissions.

[2] https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/

[3] https://ghgprotocol.org/sites/default/files/standards/ghg-protocol-revised.pdf

[4] https://legiscan.com/NY/text/A04123/id/2839211/New_York-2023-A04123-Amended.html

[5] https://www.nysenate.gov/legislation/bills/2023/A4123/amendment/A#:~:text=2023-A4123 - Summary,two and scope three emissions.

[6] https://dart.deloitte.com/USDART/home/publications/deloitte/heads-up/2023/california-climate-legislation-sweeping-impacts