S2 Considerations for a Climate-Related Scenario Analysis

Explore vital considerations outlined by the IFRS S2 standard for conducting a climate-related scenario analysis, essential for enhancing resilience and meeting compliance standards

Introduction

In paragraph 22 of the IFRS S2 Standard, companies are required to evaluate the “resilience of the entity’s strategy and business model to climate-related changes, developments and uncertainties.” Entities should use a “climate-related scenario analysis” to evaluate its climate resilience. Before a company performs a scenario analysis, several considerations should be taken into account. Such considerations are key to helping a company understand the scope, nature, and timing of the analysis they are about to undertake.

The purpose of this article is to explain these considerations as outlined by the IFRS S2. For readers interested in what a climate-related scenario analysis is, please refer to this article.

Circumstances Surrounding the Entity

Per paragraph B2, the approach used by a company to evaluate climate resilience must be “commensurate with its circumstances at the time the entity carries out its climate-related scenario analysis,” meaning entities should take into consideration their own condition at the time of the analysis. Specifically, companies need to consider their a) exposure to risks and opportunities, and b) available skills. An entity’s circumstances will directly impact the approach used in its scenario analysis.

- Exposure to risks and opportunities. Consideration of exposure to risks and opportunities must be factored into the approach taken in a scenario-analysis. Per Paragraph B4, “the greater the entity’s exposure to climate-related risks or opportunities, the more likely it is the entity would determine that a more technically sophisticated form of climate-related scenario analysis is required.” A more technical approach would require quantitative analysis of high-quality data inputs. For more information on climate-related risks or opportunities, refer to .

- this article (link forthcoming)

- Skills, capabilities, and resources available. Not all companies have the resources or developed skills to perform a complex climate-related scenario analysis. S2 allows entities who have just implemented a scenario analysis to use a less intensive approach. Entities should use available resources to invest in scenario analysis skills and capabilities. As companies gain experience with scenario-related analysis, the complexity and scope of their analysis should also increase.

Building an Entity’s Scenario Analysis Approach

Once an entity has assessed both its exposure to risks and opportunities and its available skills and resources, it must build its analysis. When planning its analysis, the entity must determine the following three components.

1. Level of Analytical Approach

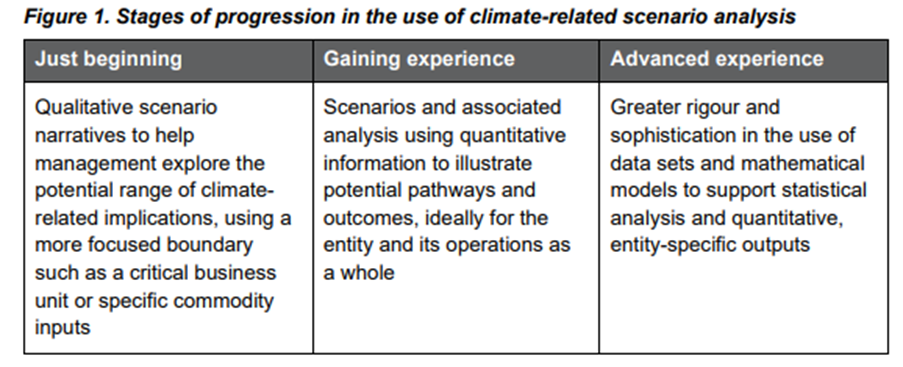

In a January 2023 staff paper, the IFRS allowed companies to take different approaches to climate-related scenario analysis, depending on their circumstances. The IFRS drew upon the Task Force on Climate-related Disclosure (TCFD) in shaping their framework. The TCFD outlines three approaches for varying levels of exposure to climate disclosures. Below is the table referenced in the staff paper.

As outlined in the table, companies just starting to use scenario analysis can defer to a limited qualitative scenario. As companies become more experienced in performing scenario analyses, they are expected to move from qualitative to quantitative inputs. Advanced companies begin to use detailed mathematical models and statistical analysis to assess climate resilience. Paragraph B17 confirms that climate-related analysis can change from one reporting period to the next according to the entity’s circumstances.

Quantitative information is preferred by the IFRS. Paragraph B14 places an emphasis on a broad analytical approach. Entities that can consider “all reasonable and supportable information” related to the analysis “without undue cost or effort” will have a stronger basis for their resilience assessment.

2. Timing

While entities should disclose their climate resilience in each reporting period, the climate-related scenario analysis has a separate timeline. Paragraph B18 suggests entities carry out their analysis according to their “strategic planning cycle,” which can span several years. The content of the annual climate resilience disclosures that take place between strategic planning cycles can go unchanged. Companies need not update their climate resilience disclosures until a new climate scenario analysis has been performed. When performing a new scenario analysis, any considerations taken (about inputs, level of analytical approach, methodology, etc.) when preparing an initial climate-related scenario analysis must be reevaluated.

3. Inputs Used

Inputs into a scenario analysis are considered based on the amount of reasonable information available. When selecting inputs, entities must consider information about past events, current conditions and forecasts of future conditions, and other relevant information. Inputs can include quantitative data from publicly available sources, qualitative judgments, or existing climate scenarios produced by third parties.

An entity must use judgment when determining the mix of inputs for its analysis. When available, detailed quantitative inputs are preferred. Existing scenario analysis performed by third parties, potential entity-specific variables, or other information relevant to an entity’s situation can be used as inputs in the scenario analysis. The IFRS suggests that companies use free publicly available example scenarios from “authoritative sources.” These scenarios can describe environmental trends or potential changes in the regulatory environment. S2 clarifies: “For example, an entity with operations concentrated in a jurisdiction where emissions are regulated—or are likely to be regulated in the future—might determine that it is appropriate to carry out its analysis using a scenario consistent with an orderly transition to a lower-carbon economy or consistent with relevant jurisdictional commitments to the latest international agreement on climate change.”

When determining inputs, paragraph B13 emphasizes that entities focus on information that helps financial statement users understand “the resilience of the entity’s strategy and business model to climate-related changes.”

As companies look to transition to the new climate standards issued by the IFRS, they must begin to plan their own climate-related scenario analysis. Companies will need to consider their level of analytical approach, the timing of their analysis, and the inputs used before attempting a scenario analysis. By taking into account the above considerations, companies can accurately perform an analysis in compliance with S2.